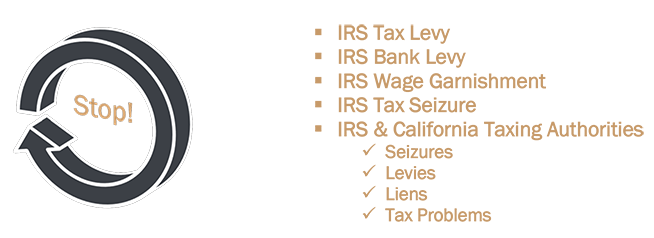

IRS Levy and Wage Garnishments

How does an IRS Levy / IRS Wage Garnishment work?

“Unlike other levies, a levy on a taxpayer’s wages and salary has a continuous effect. It attaches to future payments, until the levy is released. Wages and salary include fees, bonuses, commissions, and similar items. All other levies only attach to property and rights to property that exist when the levy is served.” (per IRS IRM). An example is provided showing that if “your bank account is levied, it only reaches money in the account when the levy is served. It does not reach money deposited later.” Additional explanation is provided at this IRS levy link, including amounts exempt from levy. What if your Employer Threatens to Fire you because of a Levy? The IRM advises that such may be a violation of federal law, subjecting an employer to fine and potential imprisonment. See discussion here at 5.11.5.2. Of course, the reality is that such doesn’t pay your bills when you need the funds. And with the economy, other “reasons” to terminate employment are not hard to come up with.

Bank Levies:

A bank must wait 21 calendar days after an IRS levy is served before sending payment. Then, on the next business day, it must turn over the taxpayer’s money. To read more about IRS bank levies, click here.

What if a levy on your wages is causing your family a hardship?

The IRS may release a levy, but that doesn’t mean that you are exempt from paying the balance. Call IRS Levy Relief.com to seek immediate relief.

How does the Federal Payment Levy Program work?

Under this program, the IRS, in conjunction with the Department of the Treasury, Financial Management Service (FMS), can collect your overdue taxes through a continuous levy on certain federal payments disbursed by FMS (financial Management Service). The following is a list of federal payments that can be levied through the FPLP:

- federal employee retirement annuities,

- federal payments made to you as a contractor/vendor doing business with the government (including Defense contracts),

- federal employee travel advances or reimbursements,

- certain Social Security benefits paid to you,

- some federal salaries,

- Medicare provider and supplier payments.

- Railroad Retirement Board benefits paid to you.

Read about how IRS Levy practice harms Taxpayers who are experiencing Economic Hardship

See National Taxpayer Advocate’s FY 2011 Objectives Report to Congress, (go to page 18 of report) Copy of Report is at TaxSOS.com. Enter with this link to see portion dealing with IRS levy. As discussed in the Advocates report, for the IRS to proceed with an IRS levy where there is economic hardship is not only an abuse of discretion (CDP hearing), but is wrong as a matter of law, even if the taxpayer hadn’t filed all required tax returns. See related tax court case concerning IRS levy and economic hardship Kathleen A. Vinatieri. The Internal Revenue Code authorizes the Internal Revenue Service (IRS) to collect taxes by levy upon a taxpayer’s property or rights to property if the taxpayer neglects or refuses to pay the tax within 10 days after receiving a notice and demand to pay the tax. The IRS can levy a taxpayer’s salary and wages, bank accounts, or other money that is owed to the taxpayer. An IRS levy on your bank account or an IRS wage garnishment can result in economic hardship. It can render you unable to pay critical business and personal expenses. These type of seizure actions are very easy for the IRS to accomplish. The IRS wanted your attention, and now they have it. Of course, the consequences upon you and your family are immediate, and many times devastating. My law practice is devoted to IRS tax collection matters. An IRS levy or garnishment is an urgent matter. IRS levy and IRS Wage Garnishment War Room – Stories of the American Taxpayer along with actual case studies (below).

You Need Professional Help:

The frustration and devastation which Americans feel when hit by an IRS levy, Wage garnishment, Wage levy, Pay levy or IRS Tax Levy, by whatever name you call it in your panicked response, is very real – and you are not alone. Unless you have been subjected to such economic and savage personal attack, you probably can’t begin to relate. The checks you wrote are bouncing, bank charges are mounting and your family needs food. The housing needs to be paid and the utility company is threatening to shut off your electric power. The IRS levy or Wage Garnishment is causing additional damage.

You previously put off responding to the prior notices from the IRS – rationalizing that you will get to it “later”.

Well, “later” has come. You call the IRS and they want your name, social security number and bank account information. You explain that they already have it because the IRS levy just cleaned out your entire bank account. Or, they ask “where do you work”. Again, they have the information because your pay check has been nailed by the IRS garnishment. The IRS continues to ask you an onslaught of questions about your financial situation (e.g., your rent amount, your utilities, where you work, where your spouse works, etc…). You begin to feel that the IRS person is merely regurgitating questions to you and is robotically typing your information into a computer system. You wonder – are they even thinking? But, you need the IRS levy release or wage garnishment release. The scary reality is that in many cases the IRS employee is just keypunching and are waiting for the computer to give them an answer. Moreover, many times they aren’t even entering your data correctly. Your “sixth sense” tells you that something isn’t right. But you continue on. You answer the questions without preparation and review of your actual information and the law. You feel that being cooperative will help you get the IRS levy release or Wage garnishment release.

What have you done to yourself?

In reality, you have provided the IRS with a roadmap to assets and income sources for future IRS levy and IRS seizure action. Further, without proper factual review and legal analysis before calling, you were not prepared, and have not taken into account all of your necessary living expenses and legal provisions. The result, the IRS employee advises you that you must pay a certain amount per month which you actually can’t afford. You agree to the number out of desperation to merely get some relief from the IRS levy or Wage garnishment. For the moment, however, you are glad to get the IRS off of your back.

What has the IRS done to you?

The IRS has set you up to fail. The problem: your “agreement” wasn’t based upon economic reality and most probably doesn’t involve a long-term plan of action to resolve your tax problem. You struggle through the year. When the due date comes for the tax return, you file your tax return with a balance due and can’t pay. You again delay proper response. You don’t know what to do and are paralyzed. You default your agreement and the IRS again issues another IRS levy or Wage garnishment. Now when you call, the IRS condescendingly states – “you had an agreement before and didn’t live up to it”. Now, the IRS refuses to release the IRS levy or Wage garnishment.

Read about some actual IRS levy/ IRS Wage Garnishment case studies (see if this sounds like you).

More Information about IRS Levy / IRS Wage Garnishment:

(1) Due Process in IRS Collection Actions IRS Restructuring and Reform Act of 1998 – Collection Due Process (Explanation in Report) Final Regulations 26 CFR 301.6320 – Notice and Opportunity for Hearing upon Filing of Notice of Lien 26 CFR 301.6330 – Notice and Opportunity for Hearing before Levy

- Release of Levy – uncollectible, significant hardship

- IRS Pre-Seizure and Sale Considerations (restrictions, approval process, prohibitions etc…).

- Social Security Benefits subject to Levy

- IRS Levy on Principal Residence – Final Regulations March 28, 2005